Understanding the Current UK Mortgage Landscape: Rates, Predictions, and Repayment Insights:

- Veera Josey

- Feb 25, 2024

- 2 min read

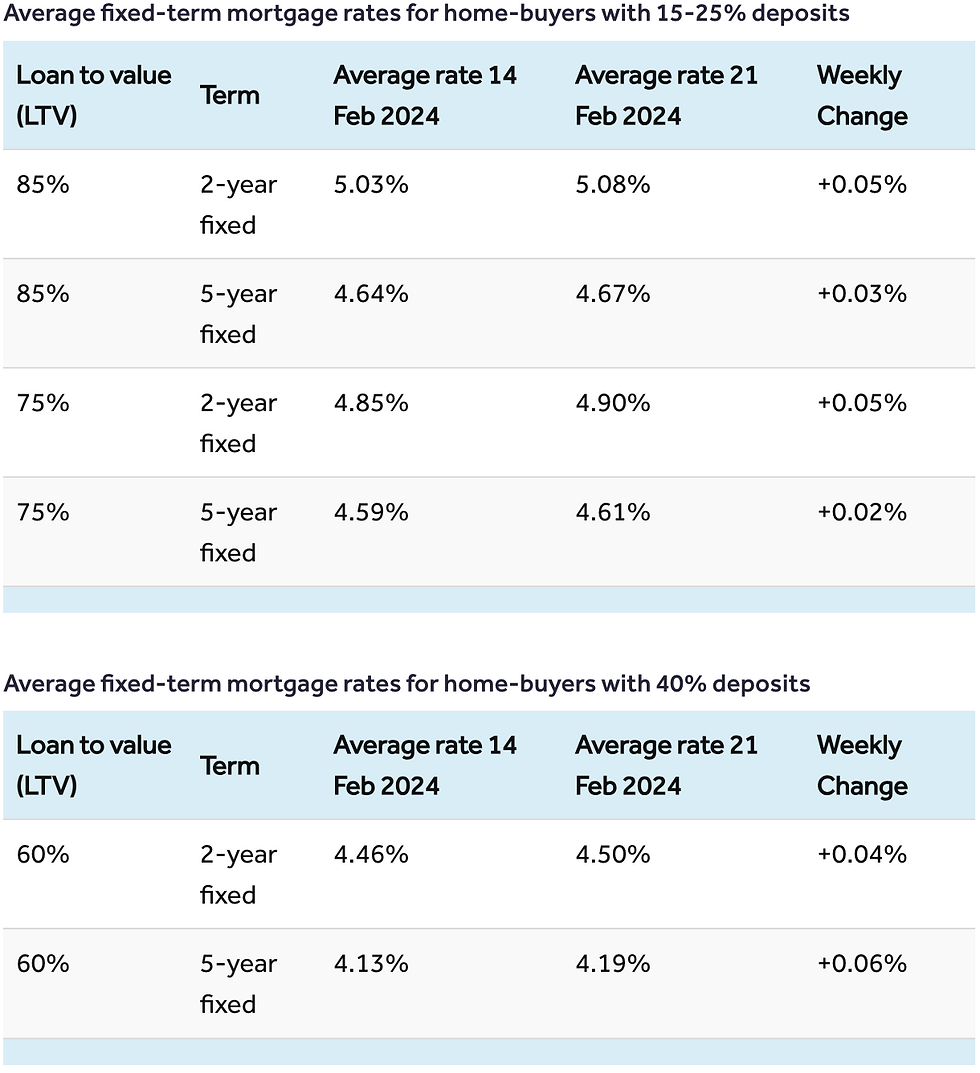

If you're in the market for a new home, understanding the current state of mortgage rates in the UK is crucial. These rates fluctuate often, prompting us to provide weekly updates on the average mortgage rates and their changes over time. It's also possible to see how these rates vary across different loan-to-value (LTV) ratios.

Current Trends in Mortgage and Interest Rates:

The topic of Base Rate adjustments by the Bank of England (BoE), which convenes approximately every six weeks, has been prevalent in the news. These decisions directly influence mortgage rates. As of August, the Base Rate has been maintained at 5.25%. Currently, the average rate for a five-year fixed mortgage stands at 4.72%, a slight increase from 4.69% last week. For two-year fixed mortgages, the average rate has risen from 5.03% to 5.08% this week. The lowest rates available now are 3.99% for a five-year fixed mortgage and 4.38% for a two-year fixed mortgage.

Mortgage expert Matt Smith notes that while average mortgage rates saw a decrease in January, they've begun to climb again due to rising swap rates, which affect lenders' mortgage costs. However, if inflation trends towards the 2% target in the upcoming months, we might see a reduction in mortgage rates. The start of this year has shown promising activity in the home-moving sector, suggesting a positive medium-term outlook, with average mortgage rates still below early January figures.

When Might Mortgage Rates Decrease?

Financial market predictions suggest that the Base Rate might have reached its peak, expecting stability into 2024 before a decrease. This could lead to fixed-rate mortgage products gradually reflecting these reductions. However, predicting significant drops in mortgage rates is complex, and influenced by various factors including inflation trends, swap rate changes, and economic stability.

Implications for Monthly Mortgage Repayments:

Considering the latest average mortgage rates, it's natural to wonder about their impact on monthly mortgage repayments. The average asking price for properties suitable for first-time buyers is currently £224,815. For an average five-year fixed, 85% LTV mortgage repaid over 25 years, the monthly repayment would be approximately £1,081, slightly higher than last year's £1,074.

Borrowing Capacity with a Mortgage:

Your mortgage borrowing capacity is primarily based on an affordability assessment, while your interest rate will depend on your deposit size or LTV. The LTV ratio is a measure of your required mortgage concerning the home's value, influencing the interest rate you're offered. The larger your deposit, the lower your LTV and potentially your interest rate.

Utilising a mortgage calculator can provide an estimate of your borrowing capacity, and applying for a Mortgage in Principle can offer a more personalised insight, bringing you a step closer to securing a mortgage offer.

Written by Veera Josey, 25th February 2024

Sources: Podium, Rightmove

Comments