January 2024 House Price Insights: Signs of Stabilisation Amid Market Dynamics:

- Veera Josey

- Jan 30, 2024

- 4 min read

House price declines are showing signs of deceleration, with a surge in agreed-upon sales during the initial weeks of 2024. The House Price Index outlines the latest property prices and market dynamics for January 2024.

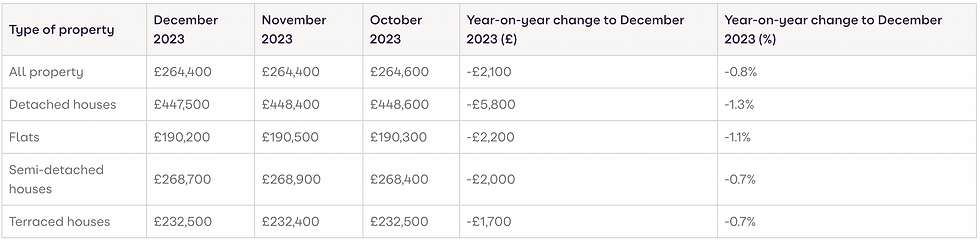

As of December 2023 (released in January 2024), the average UK house price stands at £264,400. While there is no month-on-month alteration, prices have experienced a modest decline of -0.8% in comparison to the preceding year.

The graph shows how the average UK house price has changed since 2013, now sitting at £264,400.

The ongoing adjustment to higher mortgage rates is reflected in gradual declines in house prices. However, this descent is showing signs of slowing down as more property sales are being finalised in the initial weeks of 2024. Over the year ending in December 2023, house prices experienced a decrease of -0.8%, in contrast to a more pronounced decline of -1.4% in the year leading up to October 2023.

Regionally, the most significant price drops were observed in the East of England (-2.5%) and the South West (-2.2%). Notably, Northern Ireland stands out as an exception, with house prices recording a positive growth of 3.2% throughout 2023.

Buyer interest is experiencing a notable surge in the initial weeks of 2024, driven by a robust seasonal uptick. The availability of mortgage rates below 5% has contributed to a 12% increase in buyer demand compared to the same period last year. Despite this positive trend, demand remains 13% below the 5-year average.

This resurgence in interest signifies the release of pent-up demand, which had been subdued during the latter half of 2023 due to concerns over escalating mortgage rates.

All indicators of the housing market activity are showing year-on-year increases, extending the momentum gained in agreed sales during the closing weeks of 2023 into 2024. This ongoing trend suggests a growing consensus between buyers and sellers on pricing, resolving a prolonged period of negotiation.

New sales have surged by 13% compared to the previous year, demonstrating growth across all countries and regions. Notably, Yorkshire and the Humber (+19%) and the West Midlands (+17%) have experienced substantial increases.

Moreover, there has been a significant 22% rise in the number of homes listed for sale. This uptick indicates a renewed sense of confidence among homeowners to list their properties, augmenting choices for buyers and maintaining price stability.

A notable resurgence in buyer demand has been observed in London and the East of England as 2024 kicks off. While other regions also witnessed increases in buyer demand, they generally hovered around average levels—either in line with the previous year or showing single-digit increments.

All segments of the London property market, including inner, suburban outer, and core commuter areas, experienced a comparable surge in demand. This could mark a turning point for the London housing market. In the past seven years, the capital has trailed behind the rest of the UK in both house price growth and sales figures. London's house prices rose by 13% since 2016, compared to 34% in the UK and 50% in Wales. Notably, flat prices in London increased by a mere 2% during this period.

London hit its lowest affordability in 2016, with the house price to earnings ratio exceeding 15:1. Subsequent factors, such as tax changes targeting investors and overseas buyers, the impact of the Brexit vote on job growth, the global pandemic altering travel and work patterns, and higher mortgage rates affecting premium housing markets the most, contributed to a decline in demand and pricing.

Presently, London stands as the most affordable it has been since 2014 due to low price inflation and rising earnings. However, it remains relatively expensive by UK standards, boasting a house price-to-earnings ratio of 13:1, as illustrated in the chart below comparing it to other UK regions.

While the improving affordability in London brings positive news, prospective homebuyers still confront a substantial challenge due to mortgage rates that are twice as high as those in 2021. Anticipated market conditions for London in 2024 look promising, with earnings projected to rise more rapidly than house prices, providing essential support to sales numbers.

However, it is crucial not to let the renewed market activity overshadow a realistic assessment of what lies ahead in 2024. Last year, the drop in mortgage rates to 4.2% during the first three months played a vital role in sustaining sales volumes and resulted in only modest declines in house prices. The expectation for the current year is that similar mortgage rate dynamics will influence sales volumes positively rather than exerting a significant impact on house prices.

Several factors will contribute to keeping house prices in check:

A heightened supply of homes for sale, offering buyers a more extensive range of choices, especially for larger family homes.

Half of mortgage holders are yet to transition to higher mortgage rates, making them price-sensitive and focused on value when moving.

A notable number of sellers adjusting their asking prices to attract interest, aligning with the trend observed in 2023.

Approximately one in five sellers accepting discounts exceeding 10% off the asking price, with a similar trend prevalent in London and the South East.

For sellers aspiring to make a move, realistic pricing is imperative. Although improved market conditions enhance the likelihood of a sale, it doesn't guarantee achieving a higher selling price.

Anticipated Trends in the Housing Market for 2024.

The anticipated transition to higher mortgage rates was projected to unfold gradually, particularly considering the relatively modest decline in house prices observed throughout 2023.

Foreseeably, a substantial reduction in mortgage rates in the immediate future appears improbable, with rates likely to linger within the 4% to 5% range, especially for those seeking optimal deals with substantial deposits.

While the prospect of lower mortgage rates is undoubtedly positive, their impact is expected to manifest more significantly in bolstering sales rather than instigating notable price hikes in 2024.

Written by Veera Josey, 30th January 2024

Source: Zoopla

Comments